Interest Rates

Effective Annual Rate (EAR)

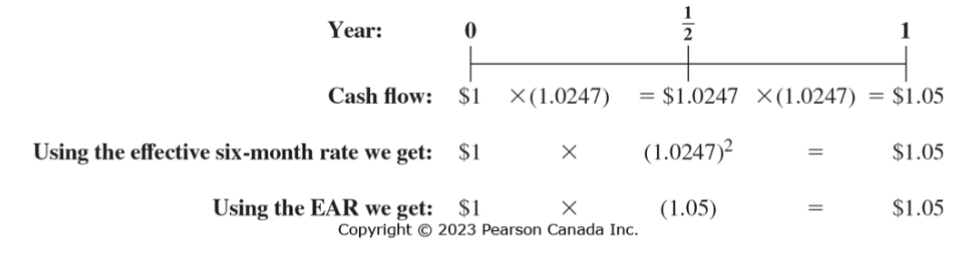

The total amount of interest that will be earned at the end of one year expressed as a proportion of the amount invested at the beginning of the year

Adjusting the EAR to an Effective Rate over Different Time Periods

In general, by raising the interest rate factor

, so a 5% EAR is equivalent to an interest rate of 2.47% earned every six months - Equivalent

-Period Effective Rate =

Annual Percentage Rates (APR)

Indicates the amount of simple interest earned in one year without the effect of compounding

- Interest earned only on the original principal amount without considering compounding of interest or interest earned on accrued interest

Converting an APR to an EAR

Formation and Importance of Interest Rates

The Determinants of Interest Rates

Inflation and Real versus Nominal Rates

Nominal Interest Rates

- Interest rates quoted by banks and other financial institutions that indicate the rate at which money will grow if invested for a certain period of time.

Real Interest Rate - The rate of growth of purchasing power after adjusting for inflation

Investment and Interest Rate Policy

- When the costs of an investment precede the benefits, an increase in the interest rate will decrease the net value created by an investment.

The Yield Curve and Interest Rates

Term Structure: The relationship between the investment term and the interest rate

Yield Curve: A plot of bond yields as a function of the bonds’ maturity date

Risk-Free Interest Rate: The interest rate at which money can be borrowed or lent without risk over a given period

Interest Rate Determination

The Bank of Canada determines very short-term interest rates through its influence on the overnight rate

- The rate at which banks can borrow cash reserves on an overnight basis from the Bank of Canada

- If interest rates are expected to rise → long-term interest rates will tend to be higher than short-term rates to attract investors

- If interest rates are expected to fall, long-term rates will tend to be lower than short-term rates to attract borrowers

Steep

- Long-term rates are much higher than short-term rates

Inverted - Long–term rates are lower than short-term rates