Bonds

Bond Terminology

Bond Indenture

- A statement of the terms of a bond as well as the amounts and dates of all payments to be made

Maturity Date

- The final repayment date of a bond

Term

- The time remaining until the final repayment date of a bond

Face Value

- AKA par value or principal amount

- Notional amount used to compute interest payments

Coupons

- The promised interest payments of a bond

- Paid periodically until the maturity date of the bond

Coupon Rate

- Set by the issuer and stated on the bond certificate

- By convention, expressed as an APR, so the amount of each coupon payment, CPN, is

Zero-Coupon Bonds

Only two cash flows

- The bond’s market price at the time of purchase

- The bond’s face value at maturity

Treasury bills are zero-coupon government bonds with maturity of up to one year

Risk-Free Interest Rates

A default-free zero-coupon bond that matures on date

- Law of One Price guarantees that the risk-free interest rate equals the yield to maturity on such a bond

- Refer to the YTM of such bond as risk-free interest rate

Spot Interest Rates

Default-free, zero-coupon yields

Coupon Bonds

- Pay face value at maturity

- Also make regular coupon interest payments

Return on a coupon bond comes from: - Any difference between the purchase price and the face value

- Periodic coupon payments

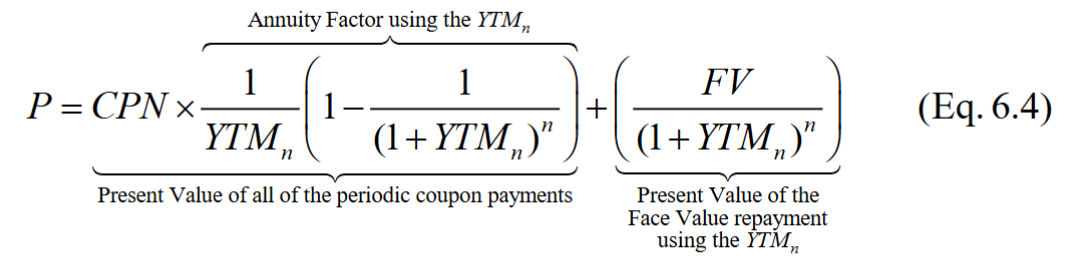

YTM of a Coupon Bond

- The coupon payments represent an annuity, so the yield to maturity is the interest rate

that equates the bond’s price, , to the present value of an annuity of coupons plus the present value of the bond’s face value, FV:

Why Bond Prices Change

- Zero-coupon bonds always trade for a discount

- Coupon bonds may trade at a discount or at a premium

- Most issuers of coupon bonds choose a coupon rate so that the bonds will initially trade at, or very close to, par

- After the issue date, the market price of a bond changes over time

Interest Rate Changes and Bond Prices

- If a bond sells at par, the only return investors will earn is from the coupons that the bond pays

- The bond’s coupon rate will exactly equal its yield to maturity

- As interest rates in the economy fluctuate, the yields that investors demand will also change

- Longer term bonds are more sensitive to interest rate changes

- More risky

- Bond with smaller coupon payments is more sensitive to interest rate changes

- More risky

Key Terms

Premium:

- A price at which coupon bonds trade that is greater than their face value

Discount: - A price at which coupon bonds trade that is lower than their face value

Par: - A price at which coupon bonds trade that is equal to their face value

Determining the Discount or Premium of a Coupon Bond

- When the coupon rate of the bond is higher than its YTM, it trades at a premium

- When its coupon rate equals its YTM, it trades at par

- When its coupon rate is lower than its YTM, it trades at a discount

Corporate Bonds

Credit Risk

- The risk of default by the issuer of any bond that is not default free

- Indication that the bond’s cash flows are not known with certainty

- Corporations with higher default risk will need to pay higher coupons to attract buyers to their bonds

Corporate Bond Yields

- Yield to maturity of a defaultable bond is not equal to the expected return of investing in the bond

- A higher yield to maturity does not necessarily imply that a bond’s expected return is higher

Bond Ratings

Several companies rate the creditworthiness of bonds

- Investment-grade bonds

- Speculative bonds

- Junk bonds

- High-yield bonds

- The rating depends on

- The risk of bankruptcy

- Bondholders’ claim to assets in the event of bankruptcy

Corporate and Provincial Yield Curves

The credit spread is the difference between the various bonds and the Government of Canada

To provide a higher YTM, the purchase price for the debt must be lower